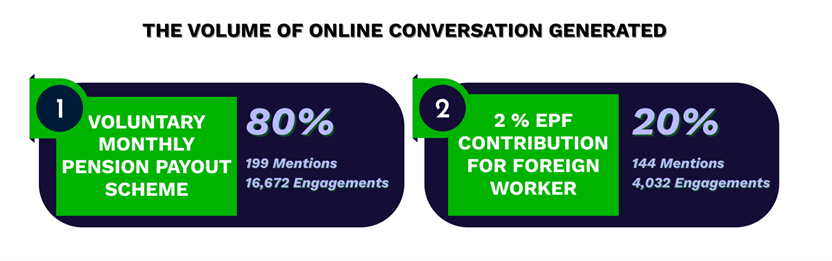

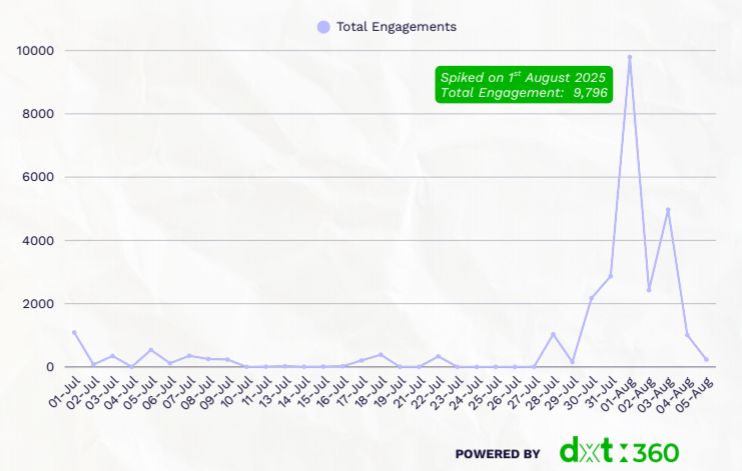

Between 1 July and 5 August 2025, the EPF reform discussion amassed 431 unique mentions and 27,700 engagements across platforms. The conversation was anything but uniform, it ranged from cautious optimism to full-blown outrage, revealing a nation split between trust in structured retirement and the fear of losing control over hard-earned savings.

The discussion on EPF payout reforms in Malaysia reflects ongoing financial concerns, while public sentiment around the OPR cut and economic anxiety shows how policies impact everyday lives. Explore our news page for more updates and stories.

Timeline of Public Reactions

Timeline of Public Reactions

Public engagement regarding Malaysia’s EPF policy reforms reached its peak on 1 August 2025, registering 9,796 interactions across platforms. This spike followed renewed debate sparked by two key proposals: the suggestion under the 13th Malaysia Plan (13MP) for a voluntary monthly pension payout scheme, and the announcement of a 2% mandatory EPF contribution for foreign workers,

Although the 13MP had hinted at installment-based EPF withdrawals as early as July, netizens began voicing strong opposition even before official policy statements were widely circulated. The response revealed a widening gap between policymaker timelines and public sentiment.

Following the initial surge, engagement tapered to 2,427 on 2 August, rose slightly to 4,972 on 3 August possibly due to renewed media attention before plummeting to just 232 by 5 August, marking a return to baseline discourse levels.

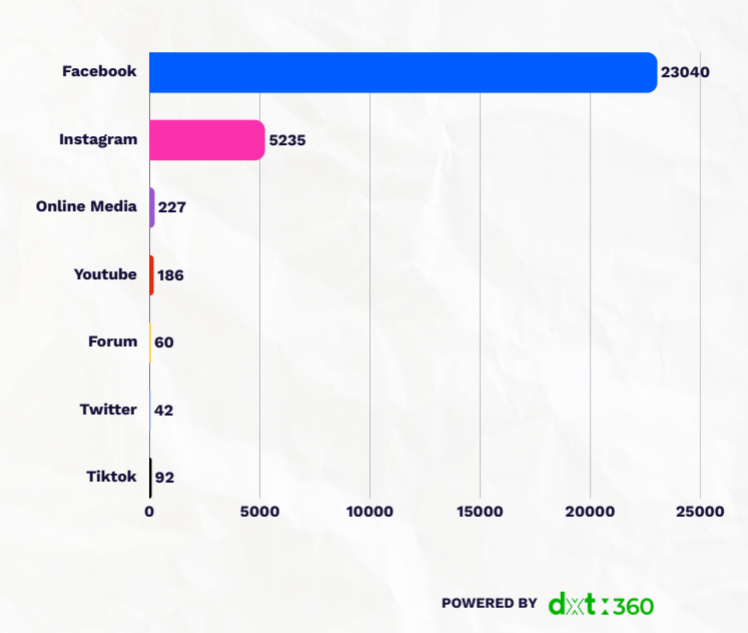

Where Did the Conversation Happen?

Where Did the Conversation Happen?

Facebook and X (formerly Twitter) dominated the space, fuelling policy breakdowns, anger-laced memes, and personal finance anecdotes.TikTok was the platform for storytelling, retirees and workers alike shared their views on the need for financial freedom.

Key Themes That Drove the Conversation

Key Themes That Drove the Conversation

Opposition to the Monthly Pension Payout Scheme (48%)

The most dominant theme was widespread rejection of the proposal to convert EPF withdrawals into monthly installments. Many netizens viewed the change as a loss of control over their own savings, arguing that lump-sum withdrawals were essential to address major financial needs such as home purchases, medical emergencies, and debt clearance. However, it is important to clarify that the proposed changes will not affect the withdrawal rights of existing members or existing contributors, who can still choose to have their funds withdrawn as a lump sum. The new pension-style payout system will mainly apply to new members who voluntarily opt in. For these new members, once a portion of their funds is withdrawn, the remainder will be automatically converted into monthly payouts. This policy was seen not only as paternalistic but also misaligned with Malaysia’s economic realities, where individuals often relied on flexible access to retirement funds to supplement inadequate social protections.

Criticism Over the 2% Contribution Uplift (20%)

The proposed mandatory EPF contribution for foreign workers triggered suspicion and backlash. Commenters speculated that this move was not about equity or long-term worker welfare, but rather a disguised attempt to generate revenue for the government. Critics questioned whether such contributions would truly benefit foreign workers or whether they would become trapped in a system with limited portability and access. The timing of the policy also coincided with broader cost-of-living frustrations, amplifying scepticism. It is important to note that the new system will primarily affect new EPF members, as their accounts will be structured differently under the proposed reforms. This restructuring aims to enhance retirement income security by managing savings within member accounts to provide a more stable monthly payout mechanism.

Financial Freedom Concerns (20%)

Another key conversation centred on the erosion of personal financial freedom. Many Malaysians expressed fear that forced pension installments would hinder their ability to plan for significant life milestones. Whether for business ventures, education, or early retirement goals, access to a lump sum was seen as critical for self-determined financial planning. The proposal, even if voluntary, was interpreted by many as a slippery slope towards greater state control over individual finances.

CPF Comparisons (9%)

References to Singapore’s Central Provident Fund (CPF) appeared frequently, with some praising its ability to provide steady income during retirement. However, most argued that Malaysia’s demographic, wage, and safety net differences made such a model unsuitable without accompanying safeguards. Concerns about inflation, insufficient retirement income, and limited job security led to calls for more holistic reforms tailored to the Malaysian context.

Broader Policy Criticism (3%)

Although less prominent, a portion of netizens tied the EPF reforms to general dissatisfaction with the Madani government’s economic management. Complaints about SST hikes, subsidy cuts, and stagnant wages coloured the conversation, creating a climate of distrust. The reforms were seen not in isolation, but as part of a larger narrative of shifting burdens onto the rakyat.

Word Cloud Analysis

Word Cloud Analysis

1. Championing Personal Choice and Autonomy

Words like “choice,” “flexibility,” “control,” and “free” highlight robust support for a voluntary monthly pension payout scheme. Netizens cherish the right to manage their hard-earned savings, with “dividen” suggesting aspirations for improved returns, reflecting a yearning for financial independence free from imposed constraints.

2. Resentment Towards Forced Constraints

Terms such as “forced,” “dikenakan,”(charged) “mandatory,” “locked,” and “cannot be” reveal intense displeasure with compulsory EPF payout rules. Netizens feel their financial liberty is stifled, with “locked” implying savings are inaccessible and “force” evoking a sense of punishment, igniting widespread frustration.

3. Outrage Over Additional Costs for Foreign Workers

Words like “costs,” “kos(cost),” “burden,” and “employer-employee” underscore fierce criticism of the extra 2% EPF contribution for foreign workers, effective October 2025. Employers lament the heavy financial toll, with “kos” and “costs”, amplifying feelings of injustice, while “employer-employee” indicates shared grievances across the workforce.

4. Economic Strain and Rising Pressures

Terms such as “naik,” “mahal”, “harga jualan,” “beras,” “diesel,” “cukai,” and “hard earned” reflect economic hardship tied to EPF policies. “Mahal”(expensive) , “naik” (rise) and “harga jualan” (selling price) indicate fears of price surges, while “beras” (rice), “diesel,” and “cukai” (tax) point to daily cost increases, making “hard-earned” savings feel increasingly vulnerable. Recent declines in EPF investment performance during the first quarter have heightened concerns about the sustainability of retirement funds.

Sentiment Breakdown

Sentiment Breakdown

Negative (80%): Dominated by strong resistance to the payout scheme and concerns about government overreach.

Neutral (10%): Included clarification posts, news resharing, and informational content.

Positive (10%): Suggested opt-in options, applauded policy clarity, or compared international best practices.

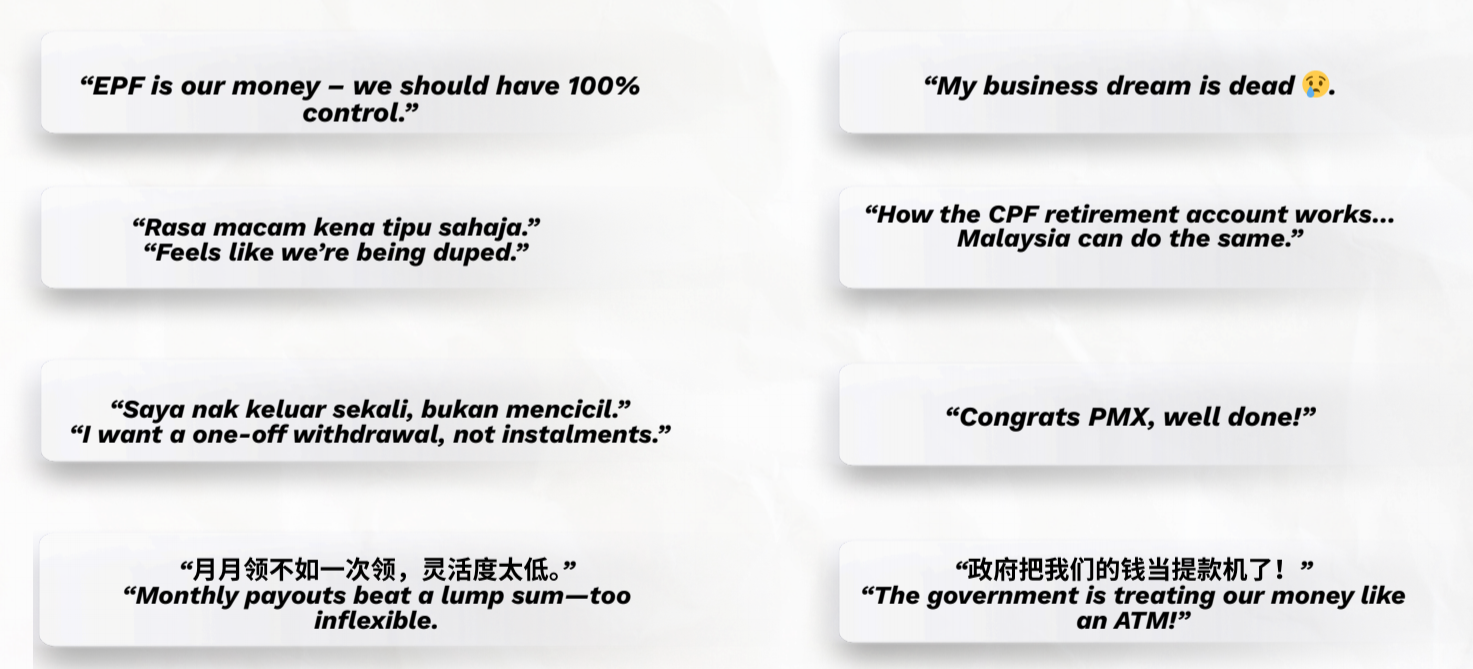

What Netizens Were Saying

What Netizens Were Saying

Final Takeaways

Final Takeaways

Malaysians want policy that empowers, not restricts. Financial freedom — especially post-retirement — must be protected.

Whether planning to travel, support children, or start a business, flexibility in withdrawals is not just a perk — it’s a necessity.

Netizens are no longer passive recipients of policy. They demand clarity, consultation, and a seat at the decision-making table.