When Bank Negara Malaysia announced a 25-basis-point reduction in the Overnight Policy Rate (OPR) on 9 July 2025, it was positioned as a confidence-boosting measure for the nation’s economic recovery. The central bank framed the move as part of its broader strategy to stimulate growth and support financial stability.

However, the public response painted a different picture. Between 1 and 14 July 2025, the policy shift generated 5,073 mentions and over 180,000 engagements across social media platforms. Instead of restoring confidence, the announcement appeared to deepen public frustration especially as it followed a string of unpopular economic changes, including the expansion of the Sales and Services Tax (SST) and recent subsidy cuts. The effect of the OPR cut on economic sentiment and financial conditions became a focal point of discussion. What was intended as economic reassurance quickly evolved into a heated online debate, fuelled by scepticism, financial anxiety, and distrust in government communication.

From Malaysians’ reactions to the OPR cut and economic anxiety to the public’s views on the BRICS Summit 2025, our coverage captures key national sentiments. Explore our news page for more updates and stories.

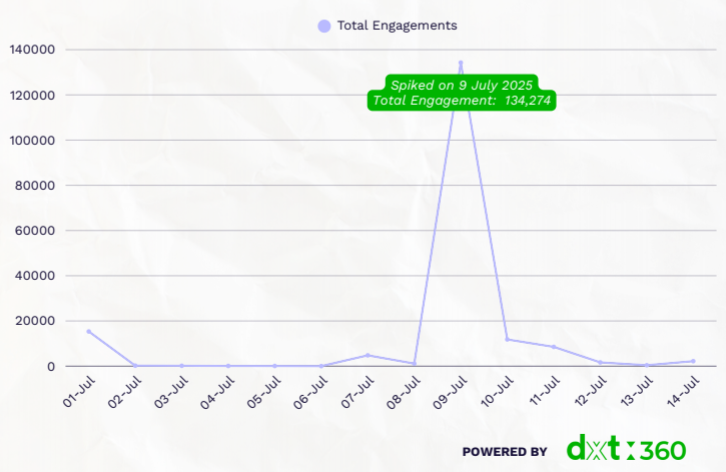

Timeline of Public Reactions

Timeline of Public Reactions

When Bank Negara Malaysia announced a 25-basis-point reduction in the Overnight Policy Rate (OPR) on 9 July 2025, it was positioned as a confidence-boosting measure for the nation’s economic recovery. The central bank framed the move as part of its broader strategy to stimulate growth and support financial stability.

However, the public response painted a different picture. Between 1 and 14 July 2025, the policy shift generated 5,073 mentions and over 180,000 engagements across social media platforms. Instead of restoring confidence, the announcement appeared to deepen public frustration especially as it followed a string of unpopular economic changes, including the expansion of the Sales and Services Tax (SST) and recent subsidy cuts. The effect of the OPR cut on economic sentiment and financial conditions became a focal point of discussion. What was intended as economic reassurance quickly evolved into a heated online debate, fuelled by scepticism, financial anxiety, and distrust in government communication.

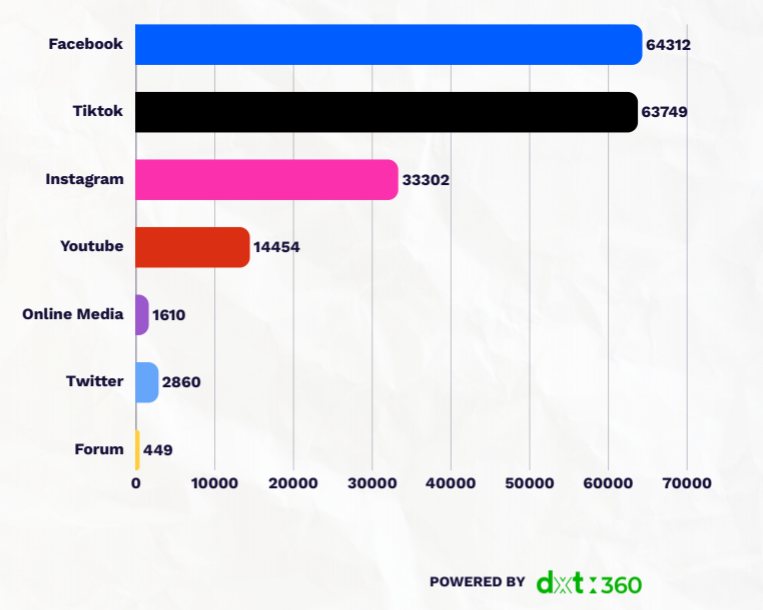

Where Did the Conversation Happen?

Where Did the Conversation Happen?

The discourse was most active on Facebook and TikTok, which together accounted for more than 127,000 engagements. Twitter housed more political commentary, while YouTube and Instagram featured short-form content, reactions, and memes. Forums hosted in-depth discussions on policy impact, particularly on household loans and inflation expectations.

What Key Topics That Drove the Conversation?

What Key Topics That Drove the Conversation?

Social media reactions to the OPR cut were shaped by 5 dominant themes, each reflecting broader socio-economic tensions in Malaysia:

Scepticism Over OPR Cut (27%)

The most prevalent theme was outright scepticism. Many Malaysians questioned whether the OPR cut genuinely reflected economic progress or simply masked underlying economic fragility. After months of repeated forecasts and government optimism with little visible relief on the ground, this announcement was met with disbelief. The public mood was laced with fatigue and growing cynicism, with some users suggesting that the decision was “motivated by political purposes” rather than based on solid macroeconomic management. For these users, the OPR cut became a symbol of economic reform,but of performative governance.

Impact on Loan Repayments (22%)

While the technical benefit of a lower OPR lies in reduced borrowing costs, many netizens doubted whether banks would pass these savings on to consumers. They questioned whether installments on housing loans, car loans, and personal financing would actually decrease and if so, by how much. Some acknowledged that even minor reductions could ease household burdens, but others pointed out that rising prices elsewhere (like groceries and transport) would likely cancel out any marginal gains. This theme reflected the rakyat’s pragmatic concern: would this policy truly make a dent in their day-to-day struggles?

Distrust Towards Government (20%)

Distrust in leadership loomed large. The timing of the OPR cut, coming soon after the SST expansion and subsidy reductions, led many to believe it was a strategic diversion rather than a meaningful solution. The frequent mention of terms like “divert attention” and “growing public dissatisfaction” highlighted how many viewed the announcement as a public relations manoeuvre. The sentiment here wasn’t merely about the policy itself—but about a widening disconnect between the government’s messaging and the public’s lived realities.

Comparisons With Past Governments (16%)

Netizens also used the OPR debate as an opportunity to evaluate the current Madani administration against previous leadership. Many questioned whether earlier governments had managed economic downturns more effectively, particularly during past interest rate cycles. The discourse blended partisan loyalty with genuine evaluation, suggesting that for some, interest rate management had become a metric for leadership credibility.

Broader Economic Concerns (15%)

For a significant portion of the public, the OPR cut raised alarm bells rather than reassurance. While some saw it as a stimulus, others interpreted it as a signal of economic weakness—pointing to low consumer confidence, inflation fears, and a sluggish growth outlook. These concerns were often tied back to broader anxieties, including the sustainability of Malaysia’s fiscal policy and the long-term impact of continuous subsidy rationalisation. The looming SST increase only compounded these fears, adding urgency to the conversation.

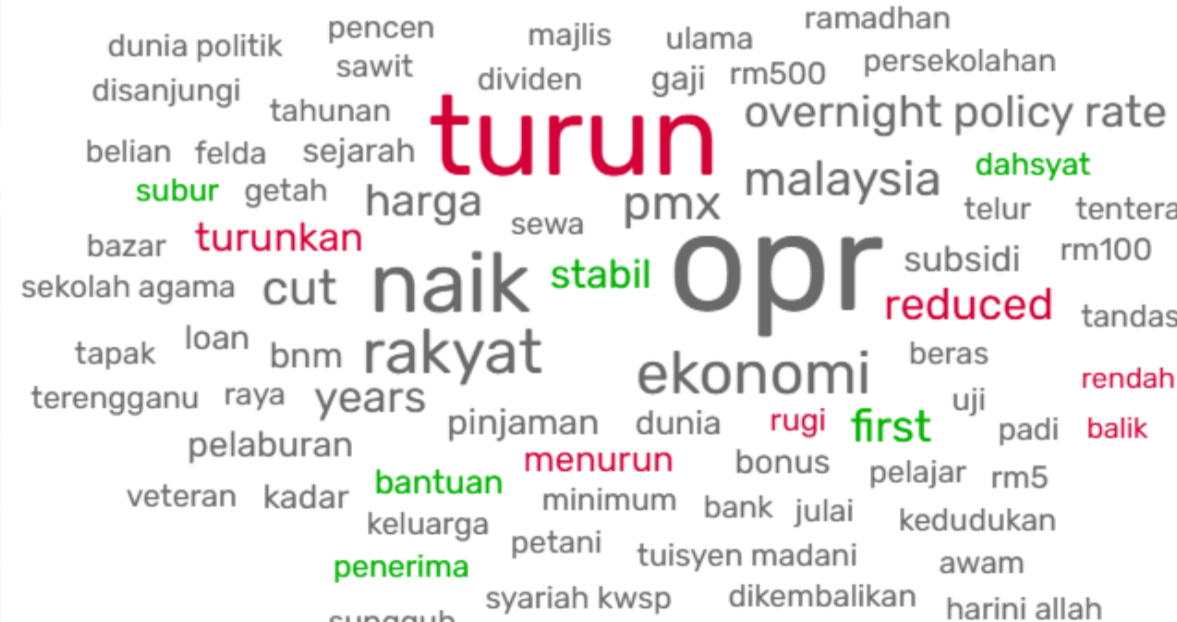

Word Cloud Analysis

Word Cloud Analysis

The most frequently mentioned keywords revealed financial stress, unmet expectations, and growing political weariness.

1. Cost of Living and Household Realities

Terms such as “rakyat,” “harga,” “subsidi,” “gaji,” “dividen,” “pinjaman,” “sewa,” and “ekonomi” revealed a deep-rooted concern with affordability. These were not abstract economic concepts,they were about real people struggling with rent, food prices, stagnant wages, and monthly bills.Mentions of “bonus,” “minimum,” “bantuan,” and “penerima” reflected a collective hope for relief or government support, whether through targeted aid or reduced loan obligations. The appearance of “pelaburan” and “tuisyen” pointed to worries about investment returns and rising education costs, especially for middle-income families. Netizens were not just asking if interest rates were lower, they were asking: “Will this change anything for my household?”

2. Political Concerns

The prominence of names and terms like “PMX,” “madani,” “umum,” “pengumuman,” and “dunia politik” indicated that the OPR announcement was viewed as highly politicised. The term “spin” captured a key sentiment, one of public fatigue with government narratives that appeared more performative than impactful.For many, this was not about financial policy alone, it was about credibility. The conversation echoed with calls for transparency, clarity, and more citizen-centric governance. The very words used revealed a growing frustration: “announcements” without meaningful change had lost their weight.

3. Taxation, Subsidies, and Economic Trade-offs

The words “cut,” “cukai,” “subsidy,” “rugi,” “rendah,” and “balik” surfaced repeatedly in a narrative that suggested net economic benefit was elusive. Any perceived gain from the OPR cut, users argued, would be offset by other financial pressures: increased taxes, removal of subsidies, and inflation.The combination of “bantuan,” “rugi,” and “balik” revealed a population acutely aware of policy trade-offs. Comments implied that the government was “giving with one hand and taking with the other,” reinforcing the idea that policy optics were prioritised over practical outcomes.

Sentiment Breakdown

Sentiment Breakdown

The majority of comments reflected frustration, disbelief, or sarcasm. Many viewed the cut as superficial and disconnected from real financial struggles.

A smaller group welcomed the move, seeing it as a potential step towards easing loan burdens or showing confidence in economic recovery.

These comments were mostly factual or inquisitive, with users seeking to understand the technical aspects and real-life impact.

What Netizens Were Saying

What Netizens Were Saying

Alt text image : Malaysian netizens’ reactions to Malaysia’s OPR Cut.

The mix of sarcasm, humour, and economic frustration underlined a growing disconnect between official narratives and public sentiment.

Final Thought

Final Thought

- The OPR cut sparked more doubt than confidence

Policy without impact fuels distrust.

- Credibility now demands consistency.

In a climate of economic anxiety, disconnected policies risk being viewed as political distractions rather than sincere efforts.

- Listening to the rakyat is no longer optional.

Governments and institutions must now engage with public sentiment as a strategic input ,not an afterthought.

At Dataxet, we turn public sentiment into strategic insight, so decisions resonate, not just echo.