From pre-launch leaks to post-launch unboxings, the buzz around Apple’s latest flagship showcased how hype can translate into a powerful halo effect across the ecosystem. At Dataxet, we dove deep into the data to uncover the narrative arc, sentiments, and competitive dynamics that made this launch a standout in the premium smartphone market.

From Apple’s iPhone 17 launch trends to Xiaomi’s bold dual-screen move, our reports span both sides of the smartphone race. Explore our News page for more updates and stories.

The Surge in Volume and Engagement: A Narrative Arc Unfolds

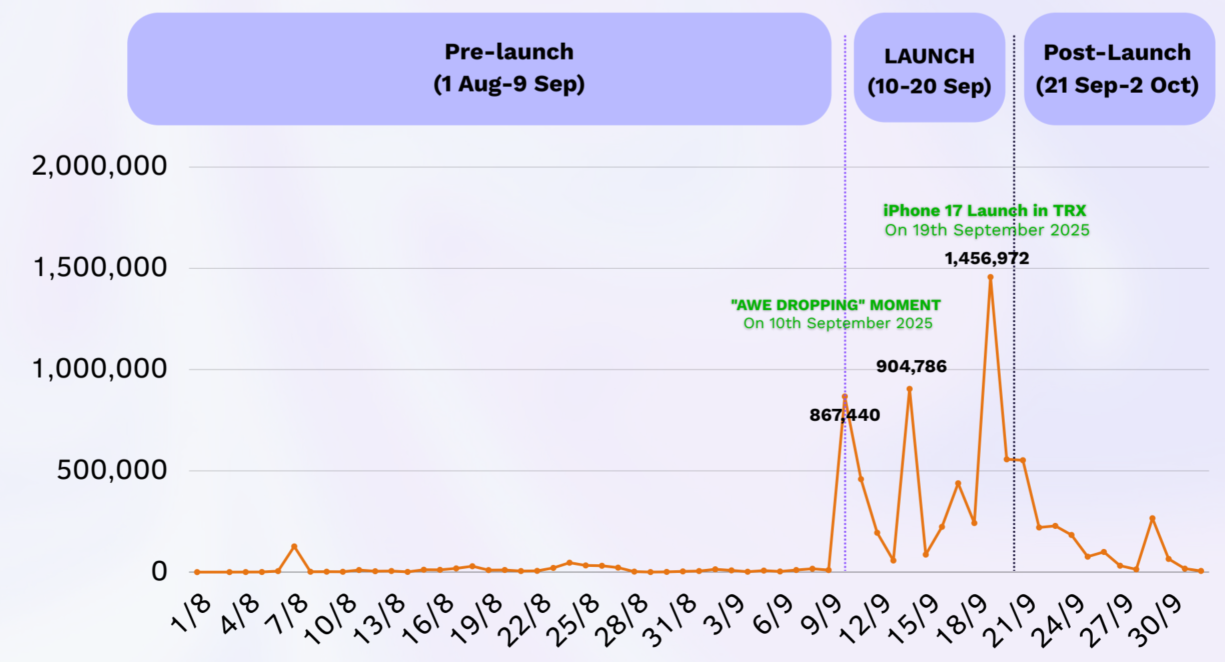

Conversations around the iPhone 17 followed a classic hype cycle, with engagements skyrocketing during the launch phase.

Pre-Launch (1 Aug – 9 Sep):

Total engagements hit 501,743, fueled by leaks, spec rumors, color speculations (hello, Cosmic Orange!), and price debates. A viral TikTok video from a phone case supplier featuring a mock-up model blurred the lines between genuine leaks and clever marketing, amassing millions of views.

Alt Text Image : Snaking queues at Apple Store TRX during the iPhone 17 launch

Launch Phase (10-20 Sep):

Engagements exploded to 5,487,682—a 10x jump! Key drivers included feature reveals, pricing memes, influencer reactions, and the local drop at Apple Store TRX on 19th September. The “Awe Dropping” event on 10th September set the stage, but the TRX launch stole the show with massive offline and online participation. A 19-year-old student, becoming the first buyer, added a relatable, youthful spark to the chatter.

Post-Launch (21 Sep – 2 Oct):

Engagements settled at 1,759,892, shifting to hands-on reviews, camera and battery tests, telco promotions, and unboxing videos. Comparisons with rivals like Google Pixel 10 and Xiaomi 17 series dominated, as users validated Apple’s claims in real-world scenarios.

This arc highlights how Apple’s orchestrated reveals and local activations turned anticipation into sustained momentum.

Key Themes and Sentiment: What Captivated Malaysians?

Our analysis revealed three core themes driving interest:

-

Camera and Tech Features Drove Interest

“Camera” appears prominently alongside “picture,” “photo,” “video,” “color,” and “tech,” pointing to significant focus on photographic and video capabilities. Terms like “experience” and “upgrade” reinforce interest in enhanced technical features, likely tied to the iPhone 17’s camera advancements. “Android” hints at cross-platform comparisons, suggesting these features are a point of discussion in the broader tech landscape.

-

Mixed Sentiments on Purchase and Value

Words like “buy,” “better,” “support,” “happy,” “proud,” and “good” (green) indicate positive sentiments toward purchasing and owning the device. However, “hate,” “wrong,” “struggle,” and “money” (red) reveal negative feelings, possibly related to cost or effort involved. “Bayar” (pay) and “pasal” (about) further suggest pricing and value debates, with “upgrade” and “time” implying considerations of timing and cost-benefit trade-offs.

-

Global and Social Elements Emerged

“Global,” “Palestine,” “donations,” and “donate” introduce a social dimension, indicating some users associate the iPhone with global causes or charitable actions.

Overall sentiment was overwhelmingly positive at 58%, with users gushing over features like Cosmic Orange and unboxings at TRX. Neutral posts (36%) focused on specs and comparisons, while negative ones (6%) griped about high prices, design, and trade-ins.

Most people are excited, mainly about the new iPhone 17 features like the Cosmic Orange colour and better zoom camera. Many also shared fun unboxing videos and first-buyer moments at the Apple Store TRX.

These are posts that are more informational than emotional. People were comparing iPhone 17 vs Xiaomi or discussing specs and international pricing. No strong feelings, just facts and discussions about the device or global rollout.

Only a small number of users complained, mostly about the high price, the design not being nice, or the trade-in processes being troublesome. These were mainly found in posts about purchasing or device build quality.

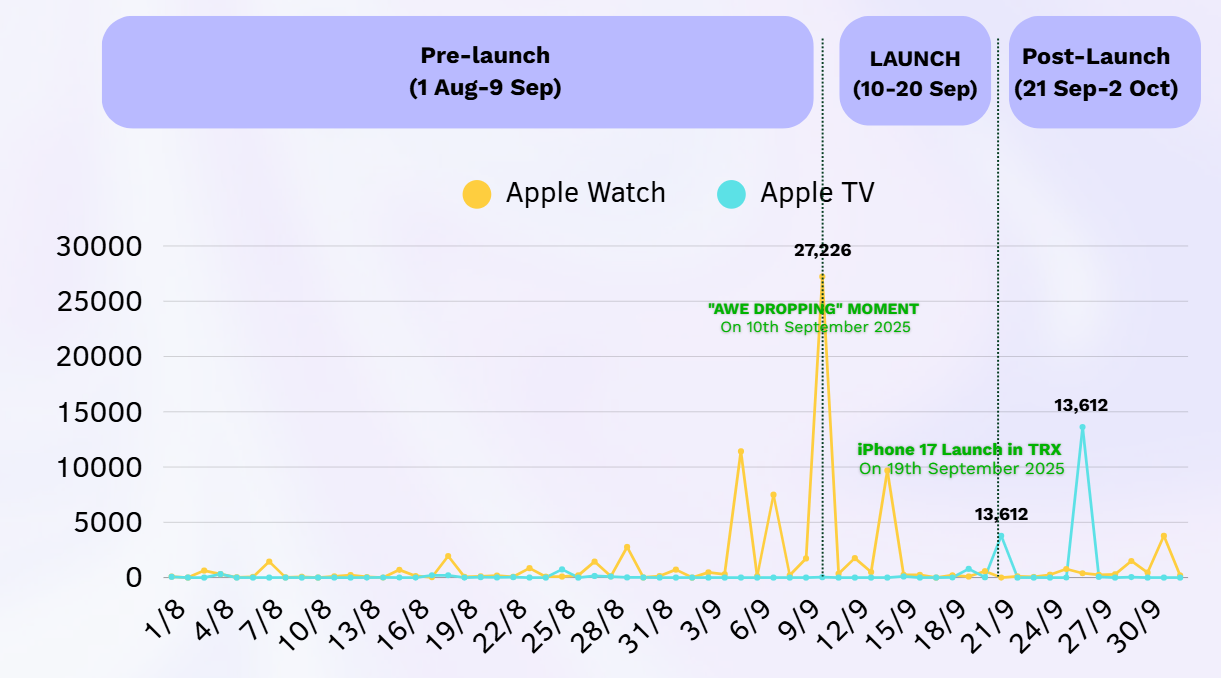

The Halo Effect: How iPhone 17 Launch Boosted Apple Watch And Apple TV

Although the Apple Watch and Apple TV recorded far lower engagement compared to the iPhone 17, both products mirrored the broader launch rhythm, showing distinct spikes in engagement during the iPhone 17’s reveal period, indicating a halo lift from Apple’s ecosystem marketing.

•Apple Watch:

Engagement rose sharply around 5-12 September, peaking at 27,000+ engagements, coinciding with the ‘Awe Dropping’ event where new Apple Watch models were unveiled alongside the iPhone 17. The smaller uptick after 25 September suggests continued interest through hands-on comparisons and mentions of fitness features in reviews.

•Apple TV:

While the overall conversation volume remained minimal, a subtle engagement lift in late September (13,000+ engagements) reflected cross-promotional spillover, as discussions around Apple’s ecosystem extended into content consumption experiences (e.g., Apple TV+ integration and smart home pairing).

Apple’s Go-To-Market (GTM) strategy shone here: a global “Awe Dropping” reveal amplified locally via TRX, while earned media like CNET’s coverage on potential foldables fueled speculation without official confirmation.

Gap Between Mainstream and Social Media Narratives

Disconnection between mainstream vs social: mainstream offers a top-down, global view, while social captures more consumer experience narratives.

Mainstream:

Focused on geopolitical context, like US tariffs under President Trump, tensions in China, and Apple’s diversification efforts.

Social:

Emphasised Malaysian experiences, such as TRX queues, first buyers (e.g., from UiTM or Bangladesh), pricing in ringgit (RM5,999 for 256GB Pro Max), unboxings, and comparisons.

Bridging the Gap:

To close this divide, brands like Apple could amplify real-time engagement on social platforms such as partnering with influencers for live unboxings or responding to user battery feedback while supplying mainstream outlets with more consumer-facing stories, such as aggregated user testimonials on features like the 48MP Fusion camera or AI integrations. This hybrid approach could foster a unified narrative, boosting authenticity in mainstream reports and adding strategic insight to social engagement.

Competitor Analysis: Conversations Of Apple Competitors Amid The iPhone 17 Launch

Competitors like Xiaomi and Google continue to innovate in hardware and software, often positioning themselves as alternatives to Apple’s ecosystem. Many competitors also emphasize differences in privacy and user tracking policies, highlighting their approaches to tracking, data collection, and transparency compared to Apple. Additionally, app ecosystems and app store policies are a key area of competition, with companies competing for both app developers and users through their app stores and related revenue models.

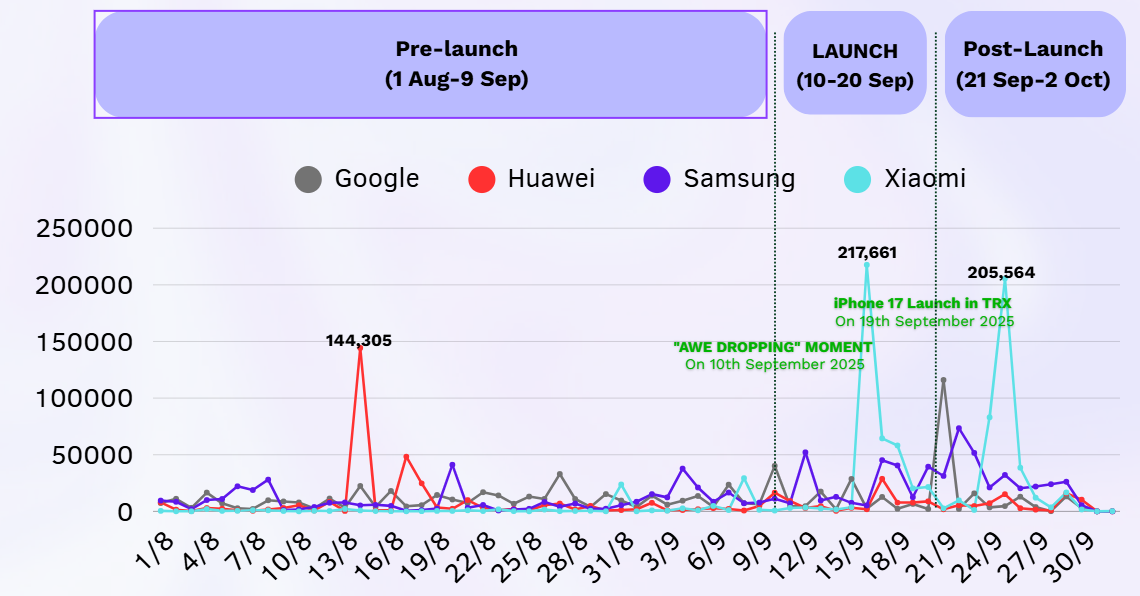

Rivals like Xiaomi jumped on Apple’s wave:

While none of Apple’s competitors matched the iPhone 17’s surge in social engagement, the chart shows that only Xiaomi strategically timed their own content drops to ride on the visibility of Apple’s launch cycle.

Pre-Launch:

The first spike in engagement, reaching 144K engagements, was driven by viral review videos from tech influencers showcasing the Huawei Pura 80’s camera at high magnification.

Launch Phase:

Strongest peak with 217K engagements, positioning the Xiaomi 17 Pro as a direct iPhone 17 Pro challenger via comparison content and media debates on dual rear displays and Leica cameras.

Post-Launch:

The second strongest peak of 205K engagements was captured during the period of unveiling the Xiaomi Pad Mini, interpreted as “ecosystem parity messaging” against Apple’s broader device family.

Samsung and Google:

Lower volumes, with minimal strategic overlap.

Xiaomi’s “mirror strategy”:

skipping ’16’ to align with iPhone numbering sparked “Who did it better?” buzz, showing how competitors can leverage Apple’s visibility.

Alt Text Image : Xiaomi 17 Pro vs iPhone 17 Pro: A head-to-head comparison

Stay Ahead with Dataxet Insights

The iPhone 17 series launch exemplifies how data-driven insights can decode market dynamics, from hype cycles to competitive manoeuvres. At Dataxet, we transform media chatter into actionable strategies to help brands navigate trends and turn challenges into opportunities.

Talk to us and maximise your media insight today!